Real Estate vs E-commerce: How Do You Maximize Your Portfolio Cashflow In 2025?

Approximate Length: 5-minute read

The Investment Property Dream vs Reality

Most Americans have been told real estate is the path to passive income. Buy properties, collect rent, build wealth.

But here's the 2025 reality check: unless you bought property before 2020, you're probably not cash flowing. And if you're trying to buy now? Good luck finding anything that makes financial sense.

The Numbers That Real Estate Agents Won't Show You:

Let's analyze a $400,000 investment property in 2025:

Purchase Costs:

- Down payment (20%): $80,000

- Closing costs: $8,000

- Initial repairs/updates: $10,000

- Total upfront: $98,000

Now you have to put all of those costs into a home where you’re lucky to make $500 per month profit according to Bigger Pockets.

Plus you have to worry about vacancies, vetting tenants, taxes, and surprise repairs that can wipe out months worth of profits overnight.

That’s not to say that rentals are a bad investment. For those with the capital and experience they make perfect sense as long term plays. However for those who are looking to maximize their monthly cashflow, there are better options. Options that require a fraction of the capital investment, and can produce far more cashflow.

Here’s What It Looks Like To Get In On An Ecommerce Store With Us:

Now let's look at a managed e-commerce investment:

Initial Investment:

- Store setup and management: $15K-30K (depending on how many stores you take on)

- No inventory risk

- As for the returns?

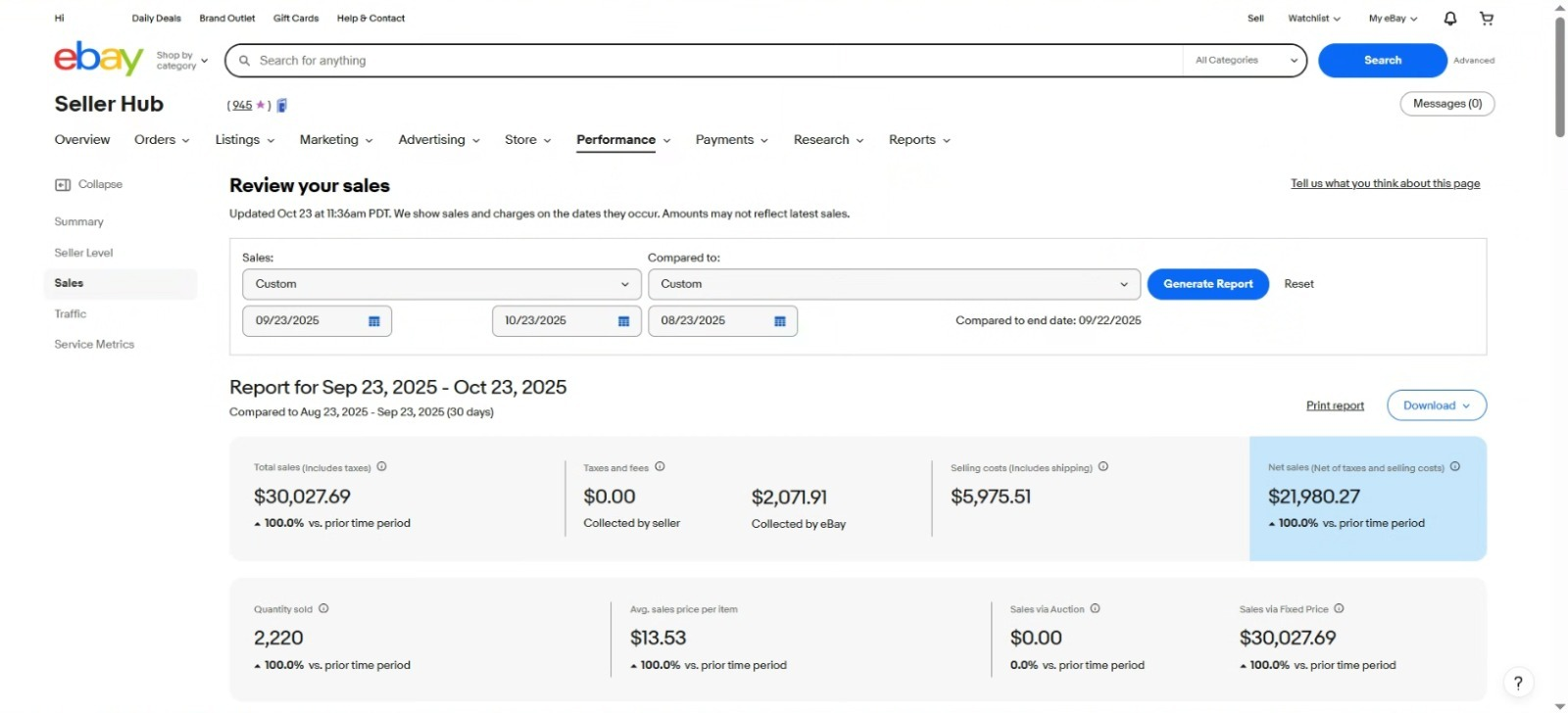

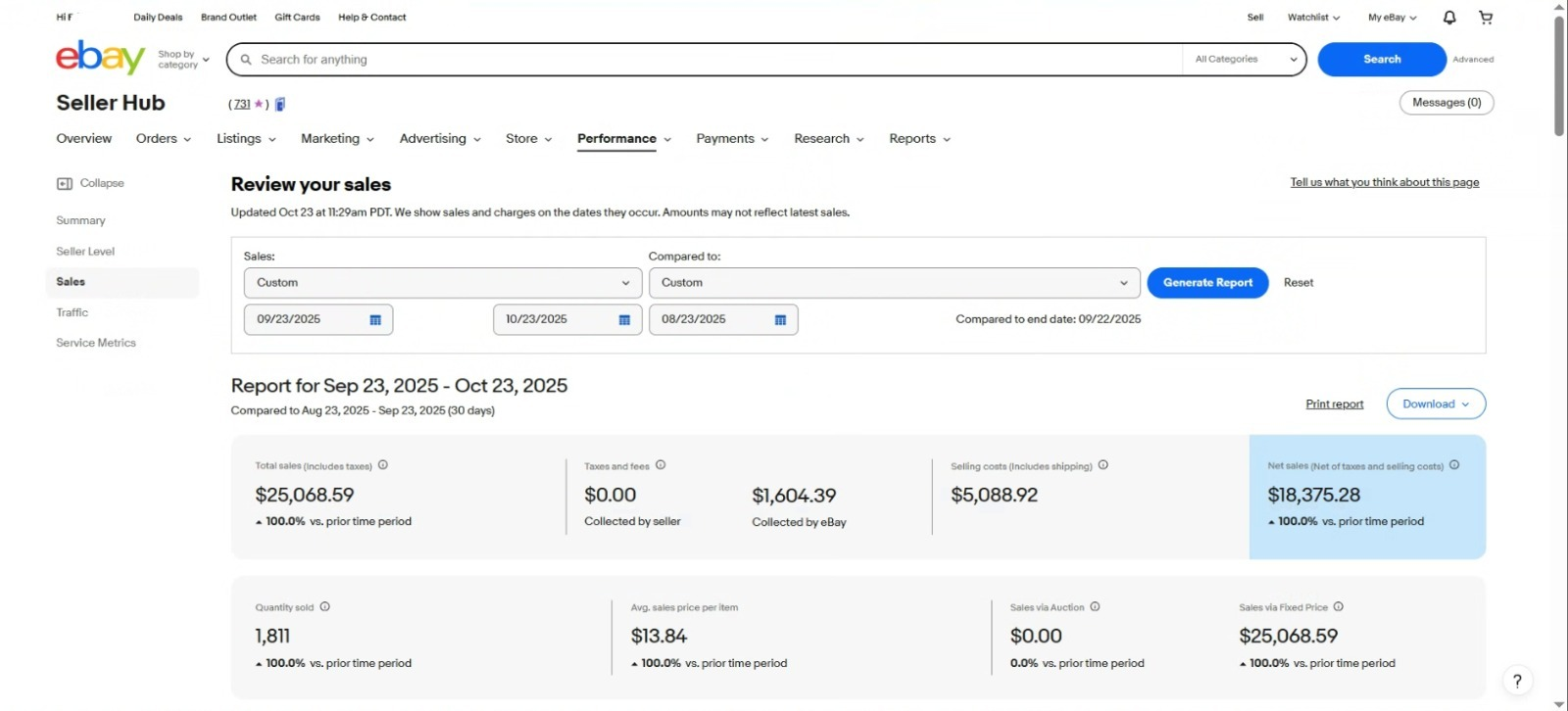

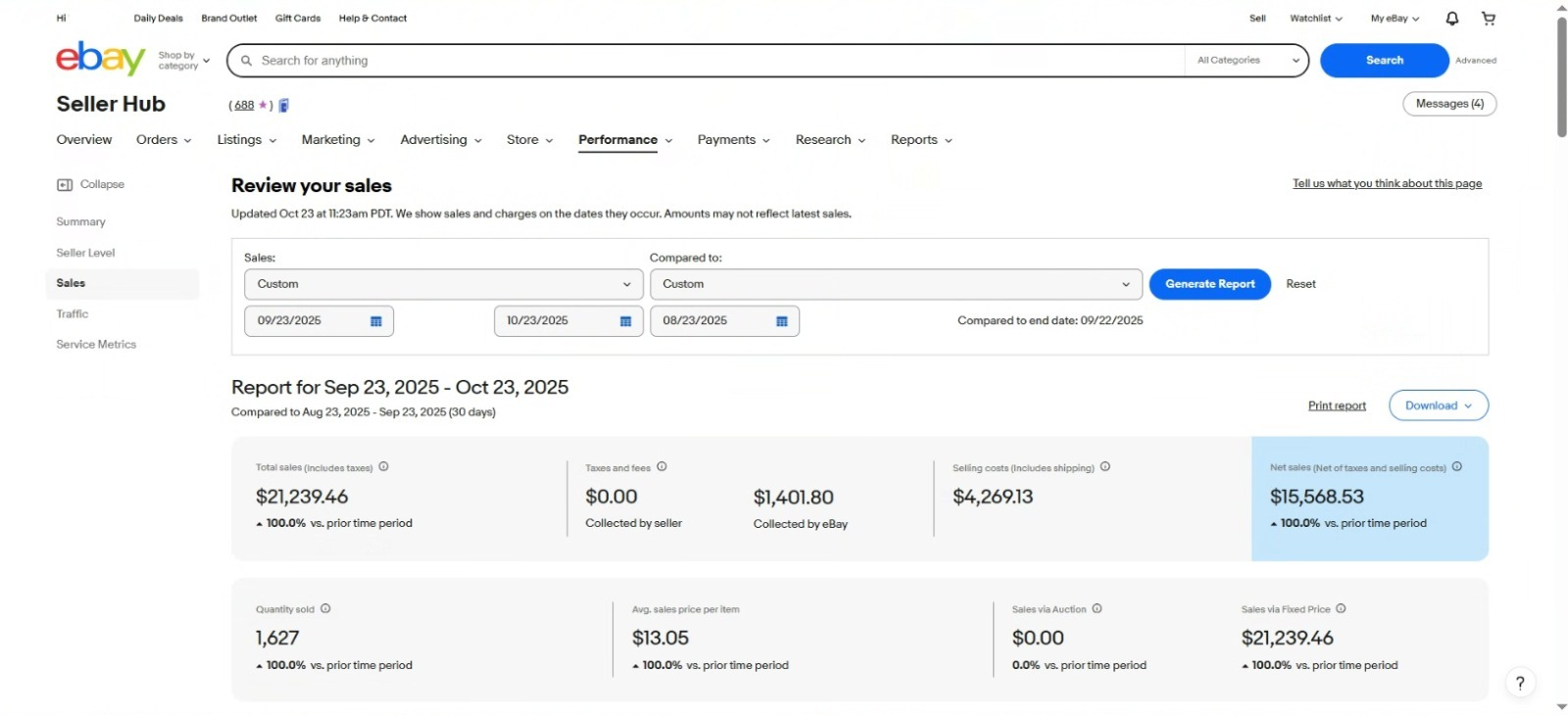

Here are some of our monthly partner returns from eBay.

Obviously this is revenue and does not include the cost of products. However, what's important to realize is that there’s no risk of unsold inventory.

Because we sell on eBay we have negotiated deals that allow us to only purchase products from suppliers after you get a sale. Compare that to the hidden costs of real estate that nobody is talking about.

The Capital Trap

That $98,000 down payment? It's locked up. Need it for an emergency? Too bad. Want to pivot to a better opportunity? Can't.

Past your initial investment, e-commerce capital stays liquid.

Market Conditions

Real Estate in 2025

- 7%+ interest rates crushing cash flow

- Property prices still near all-time highs

- Insurance costs skyrocketing (up 40% since 2020)

- Property taxes increasing annually

- Maintenance costs inflated 25%+

E-commerce in 2025

- E-commerce growing 10%+ annually

- Platform infrastructure mature and stable

- Consumer behavior permanently shifted online

- Technology reducing operational costs

The Scalability Factor

Scaling Real Estate

Want to double your real estate income? You need:

- Another $98,000 down payment

- Another mortgage approval

- Another property to manage

- Doubled stress and time commitment

Linear scaling. Linear headaches.

Scaling E-commerce

Want to double your e-commerce income? You need:

- Reinvest profits into inventory

- Add more products

- Expand to additional platforms

- Same time commitment (less than an hour weekly)

Exponential potential. Same effort.

Risk Assessment: What Can Actually Go Wrong?

Real Estate Risks

- Natural disasters

- Market crashes

- Major repairs

- Problem tenants causing damage

- Extended vacancies

- Neighborhood decline

The Diversification Reality

Real Estate "Diversification"

- Buy in different neighborhoods (all still local real estate)

- Different property types (all still illiquid real estate)

- Different cities (multiplied management headaches)

That's not diversification. That's concentration with variety.

E-commerce Diversification

- Hundreds of different products

- Multiple platforms (eBay, TikTok Shop)

- Various categories and niches

- Different price points

- Seasonal and evergreen products

True diversification within one investment.

The Professional's Decision Framework

When evaluating real estate vs e-commerce, consider:

Choose Real Estate If:

- You have $200,000+ to invest

- You bought before 2020

- You enjoy property management

- You can wait 5+ years for returns

- You're in a declining cost market

Choose E-commerce If:

- You have $25,000-50,000 to invest

- You want cash flow within 6 months

- You value truly passive management

- You need liquidity

- You want to start immediately

The Hybrid Strategy

Smart investors aren't choosing one or the other. They're sequencing:

1. Build e-commerce cash flow (Years 1-3)

2. Use profits for real estate down payments (Years 3-5)

3. Buy real estate when markets correct (Years 5+)

Use e-commerce to fund real estate. Don't wait for real estate to maybe cash flow someday.

Privacy Policy Terms of Service

Contact Us: (844) 636-0050

Copyright 2025 © Ecom Accelerator | All Rights Reserved